About Us

Economic Impact Study

The Economic Value of Gadsden State Community College

Gadsden State Community College creates value in many ways. The college plays a key role in helping students increase their employability and achieve their individual potential. The College draws students to the region, generating new dollars and opportunities for the Gadsden State service area.* Gadsden State provides students with the education, training, and skills they need to have fulfilling and prosperous careers. Furthermore, Gadsden State is a place for students to meet new people, increase their self-confidence, and promote their overall health and well-being.

* Calhoun, Cherokee, Cleburne, Etowah and St. Clair counties.

Economic Impact

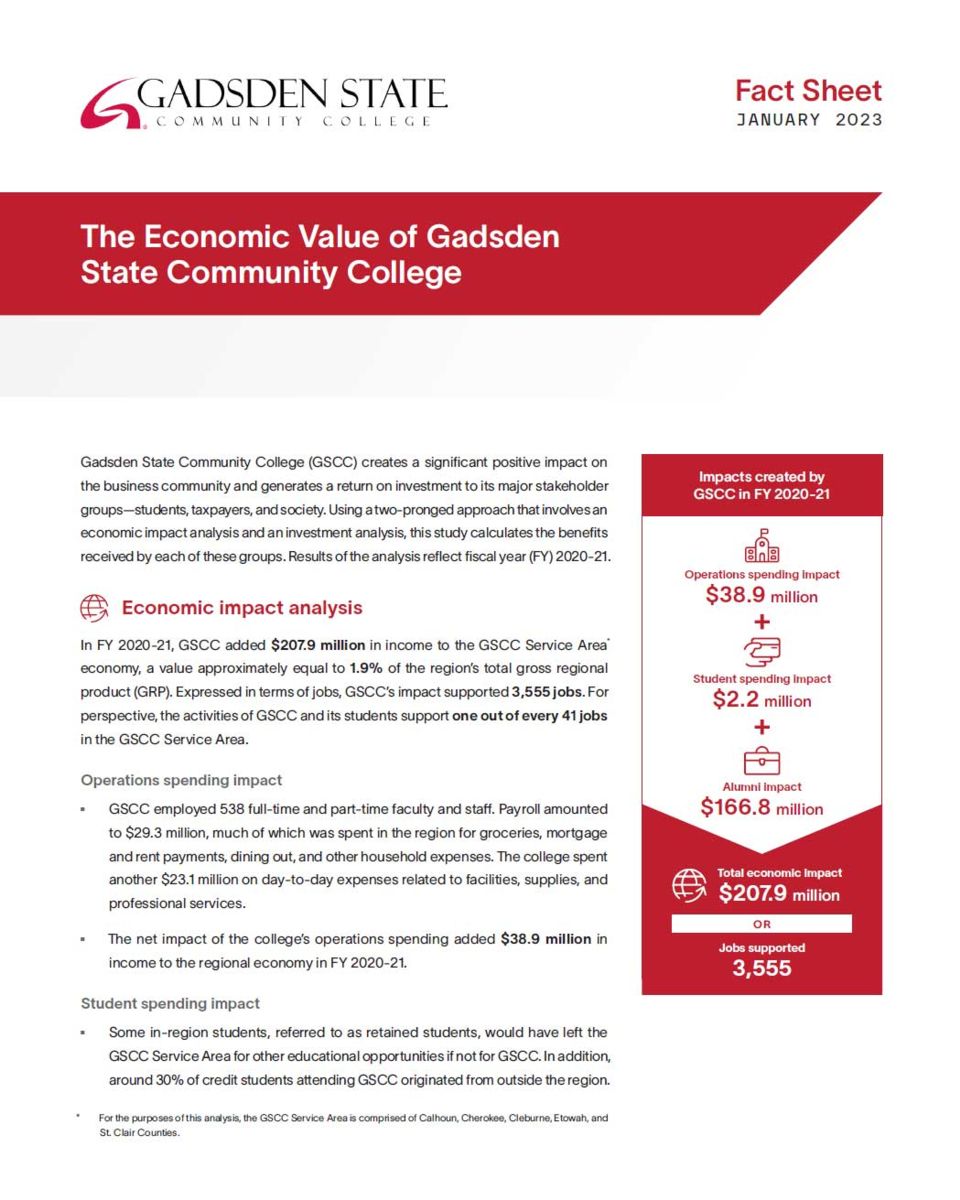

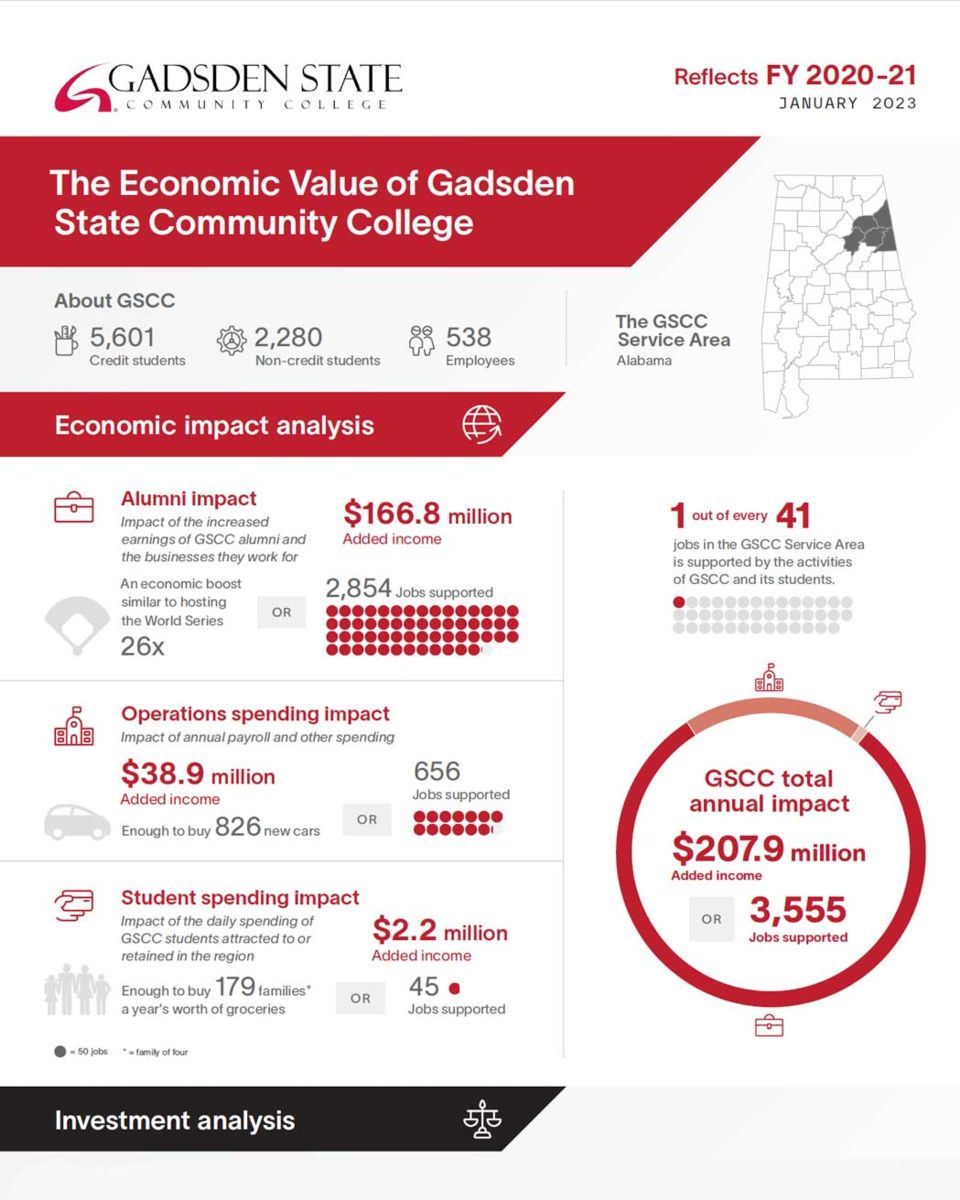

In fiscal year 2020-21, operations and student spending of Gadsden State, together with the enhanced productivity of its alumni, generated $207.9 million in added income for the economy of our service area. The additional income of $207.9 million created by Gadsden State is equal to approximately 1.9% of the total gross regional product of our service area. For perspective, this impact from the College is larger than the entire Agriculture, Forestry, Fishing & Hunting industry in the region. For perspective, one out of every 41 jobs in the Gadsden State service area is supported by the activities of the College and its students.

Investment Analysis

Students invest their own money and time in their education to pay for tuition, books, and supplies. In return, students will receive a present value of $207.7 million in increased earnings over their working lives. This translates to a return of $6.90 in higher future earnings for every dollar that students invest in their education at Gadsden State. The corresponding annual rate of return is 21.7%.

Taxpayers provided $26.5 million of state and local funding to Gadsden State in fiscal year 2020-21. In return, taxpayers will receive an estimated present value of $58 million in added tax revenue stemming from the students’ higher lifetime earnings and the increased output of businesses. Savings to the public sector add another estimated $4.7 million in benefits due to a reduced demand for government-funded social services in Alabama. For every tax dollar spent educating students attending Gadsden State, taxpayers will receive an average of $2.40 in return over the course of the students’ working lives. In other words, taxpayers enjoy an annual rate of return of 4.9%.

Access the report: